“Inflation Is Worse Than You Think, and Bitcoin Is Better Than You Know”

This statement captures two forces increasingly shaping global financial markets: persistent inflationary pressure and the growing recognition of Bitcoin’s monetary properties.

Inflation: The Hidden Erosion of Purchasing Power

Official inflation figures often understate the real cost increases households and businesses face. Housing, healthcare, education, insurance, and food prices have risen faster than headline CPI in many economies. Meanwhile, long-term currency debasement—driven by expanding fiscal deficits and accommodative monetary policy—continues to erode purchasing power quietly but consistently.

Over time, even moderate inflation compounds into a significant loss of real wealth, particularly for savers holding cash or low-yield instruments.

More on global inflation trends:

https://www.imf.org/en/Topics/inflation

Bitcoin: A Different Monetary System

Bitcoin was designed as a response to fiat monetary expansion. Its key attributes stand in sharp contrast to inflationary currencies:

- Fixed supply of 21 million BTC

- Predictable issuance schedule

- Decentralized and censorship-resistant

- Globally transferable, 24/7

These features make Bitcoin increasingly attractive as a store of value in an environment where trust in fiat currencies is under pressure.

Bitcoin’s monetary policy in detail:

https://bitcoin.org/bitcoin.pdf

Why Bitcoin May Be Underappreciated

Despite its volatility, Bitcoin has consistently outperformed traditional asset classes over long time horizons. Institutional adoption, spot Bitcoin ETFs, and growing integration into financial infrastructure suggest Bitcoin is transitioning from a speculative asset to a macro-relevant monetary hedge.

At the same time, many investors still underestimate Bitcoin’s role as:

- A hedge against currency debasement

- A neutral, borderless reserve asset

- A long-term alternative to fiat-based savings

The Bigger Picture

If inflation remains structurally higher than historical norms, assets with scarcity, transparency, and credibility may continue to attract capital. Bitcoin’s design directly addresses these criteria, positioning it uniquely in the modern financial landscape.

Whether viewed as digital gold or a new form of sound money, the gap between perceived and actual inflation—and between Bitcoin’s price and its potential—may be narrower than many realize.

You May Also Like

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch

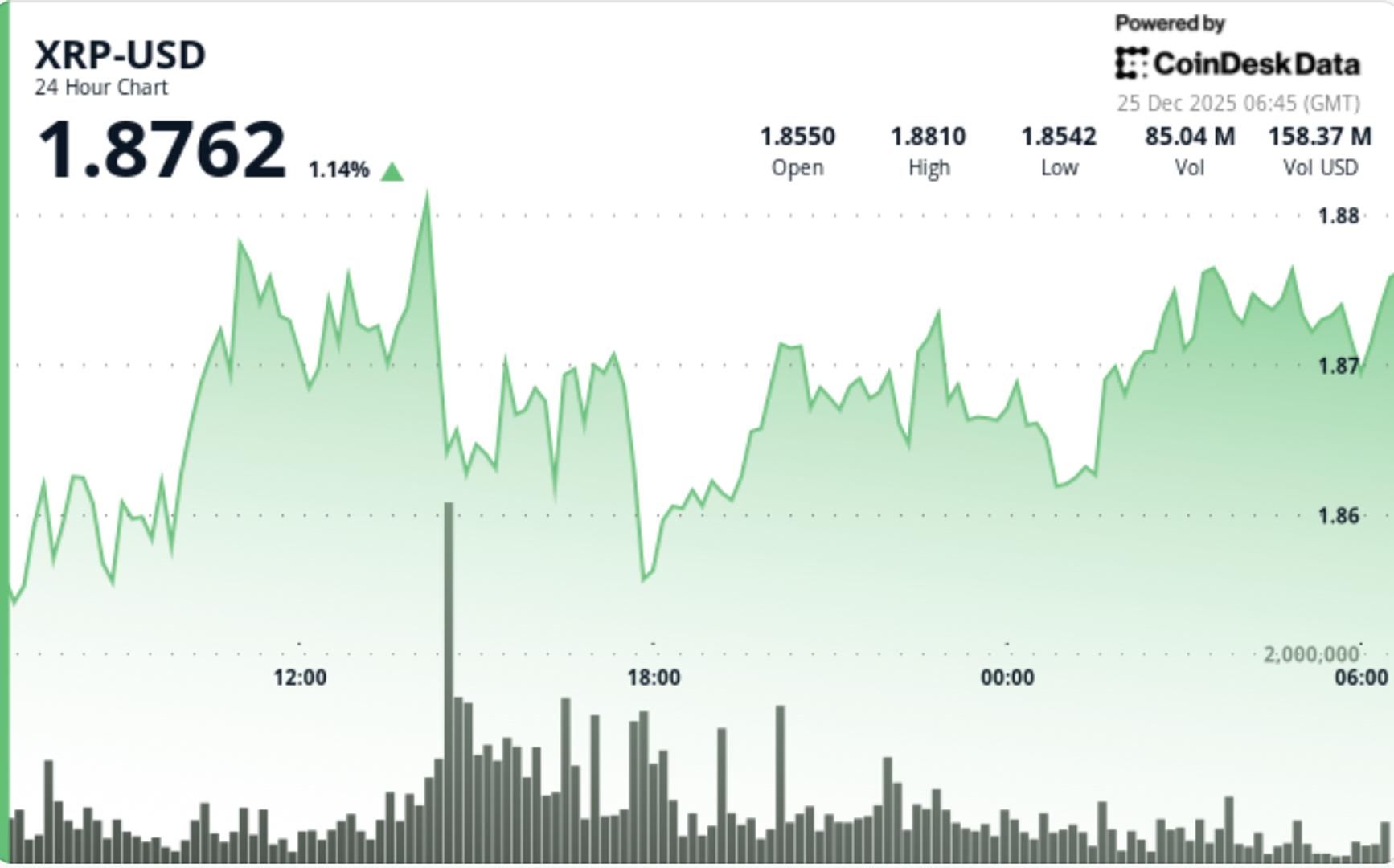

XRP ETF net assets cross $1.25 billion milestone, but price-action muted

Copy linkX (Twitter)LinkedInFacebookEmail