Solana Treasury Firm Upexi Plans Up to $1B Raise to Expand SOL Holdings

Upexi, a publicly traded treasury company with a growing focus on Solana (SOL), has disclosed plans to raise up to $1 billion to significantly expand its SOL treasury, according to recent regulatory filings.

Details of the Planned Capital Raise

Under the disclosed framework, Upexi may issue a broad range of financial instruments over time, including:

- Common stock

- Preferred stock

- Debt securities

- Warrants

- Units combining multiple securities

The flexible structure allows the company to tap capital markets opportunistically, depending on market conditions and investor demand.

More information on U.S. securities offerings can be found via the SEC:

https://www.sec.gov/edgar.shtml

Strategy: Building a Solana-Focused Treasury

Upexi’s move positions it among a growing number of companies adopting crypto-focused treasury strategies, similar to how some firms have accumulated Bitcoin or Ethereum as long-term balance sheet assets.

By targeting Solana, Upexi is signaling confidence in:

- Solana’s high-throughput blockchain infrastructure

- Continued ecosystem growth across DeFi, NFTs, and consumer applications

- Rising institutional interest in SOL-related exposure

Background on the Solana network:

https://solana.com/

Market Implications

A successful $1 billion raise could make Upexi one of the largest corporate holders of SOL, potentially increasing institutional visibility and liquidity around the asset. However, the structure also introduces dilution and leverage considerations, particularly if equity or debt issuance is used extensively.

Investors will be watching closely to see:

- The pace of capital deployment into SOL

- The mix of equity versus debt financing

- How treasury accumulation aligns with broader market cycles

Growing Trend of Crypto Treasury Strategies

Upexi’s announcement reflects a broader trend of corporates exploring digital assets as part of treasury diversification strategies. While Bitcoin remains the most common choice, interest in altcoin treasuries—especially high-performance layer-1 networks—appears to be gaining traction.

For live SOL market data:

https://coinmarketcap.com/currencies/solana/

Outlook

The proposed fundraising does not guarantee full utilization of the $1 billion authorization, but it gives Upexi significant flexibility to scale its Solana exposure over time. As regulatory clarity and institutional adoption continue to evolve, crypto-centric treasury strategies are likely to remain a focal point for both investors and analysts.

You May Also Like

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch

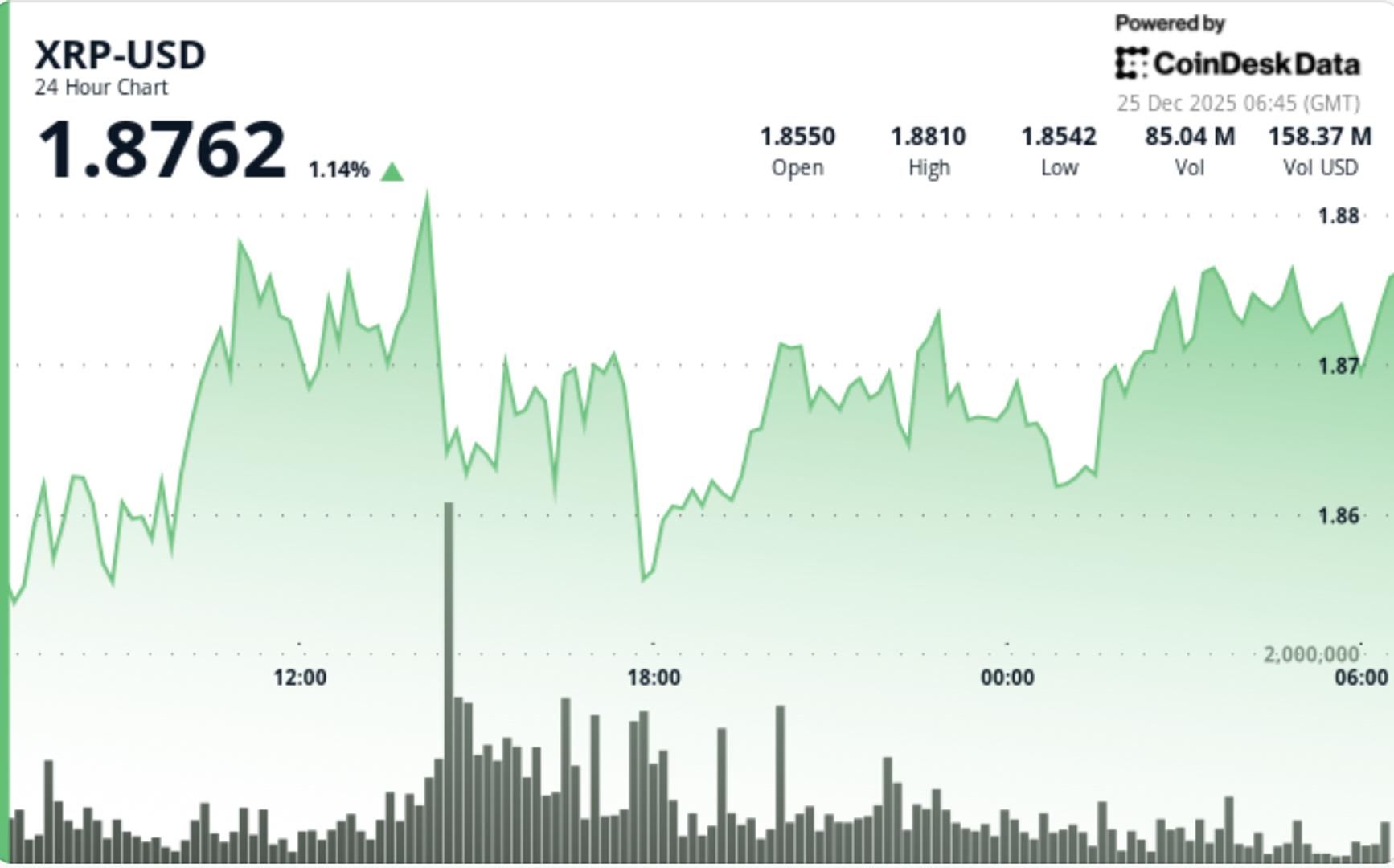

XRP ETF net assets cross $1.25 billion milestone, but price-action muted

Copy linkX (Twitter)LinkedInFacebookEmail