VanEck: Recent Bitcoin Miner Capitulation Signals a Bullish Bottom

Bitcoin miner capitulation may be flashing a bullish signal for the broader BTC market, according to a recent analysis by global asset manager VanEck. The firm points to a sharp decline in network hashrate over the past month—historically a condition that has often aligned with Bitcoin market bottoms rather than tops.

Steepest Hashrate Decline Since April 2024

VanEck notes that over the past 30 days, Bitcoin’s network hashrate experienced its steepest decline since April 2024. Hashrate measures the total computational power securing the Bitcoin network and is widely used as a proxy for miner participation and confidence.

A rapid drop in hashrate typically indicates miner capitulation, a phase where less efficient miners shut down operations due to rising costs, falling profitability, or price pressure. While this may appear negative at first glance, historical data suggests otherwise.

Hashrate Declines Often Align With Market Bottoms

According to VanEck’s research, significant hashrate drawdowns have historically occurred closer to Bitcoin price bottoms than market tops. This pattern implies that miner capitulation often marks the exhaustion of selling pressure, as miners who are forced to sell BTC to cover operational expenses have largely exited the market.

Once weaker miners are flushed out, the remaining mining cohort tends to be more efficient and financially resilient—setting the stage for improved network stability and potential price recovery.

Data Supports Positive Forward Returns

VanEck highlights a compelling historical statistic:

When 90-day Bitcoin hashrate growth turns negative, Bitcoin has delivered positive returns over the subsequent 180 days approximately 77% of the time.

This data reinforces the idea that miner capitulation phases often precede medium-term bullish price action. While not a guarantee, the odds have historically favored upside following such conditions.

Why Miner Capitulation Can Be Bullish

Miner capitulation is often viewed as a form of market cleansing:

- Inefficient miners exit the network

- Forced BTC selling pressure declines

- Network difficulty adjusts downward

- Remaining miners operate with healthier margins

Together, these dynamics can reduce structural selling pressure and support a more sustainable price recovery.

Broader Market Context

The latest hashrate decline comes amid ongoing macro uncertainty, fluctuating energy costs, and post-halving adjustments within the Bitcoin mining industry. Following the 2024 Bitcoin halving, miner revenues were cut in half, increasing stress on marginal operators.

Despite short-term volatility, institutional analysts like VanEck view these stress events as structurally constructive for Bitcoin over the medium to long term.

Outlook

While VanEck cautions that short-term price movements remain unpredictable, historical trends suggest that the current miner capitulation phase could represent a favorable accumulation window for long-term investors.

As always, market participants should combine on-chain indicators with macroeconomic analysis and risk management strategies.

You May Also Like

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch

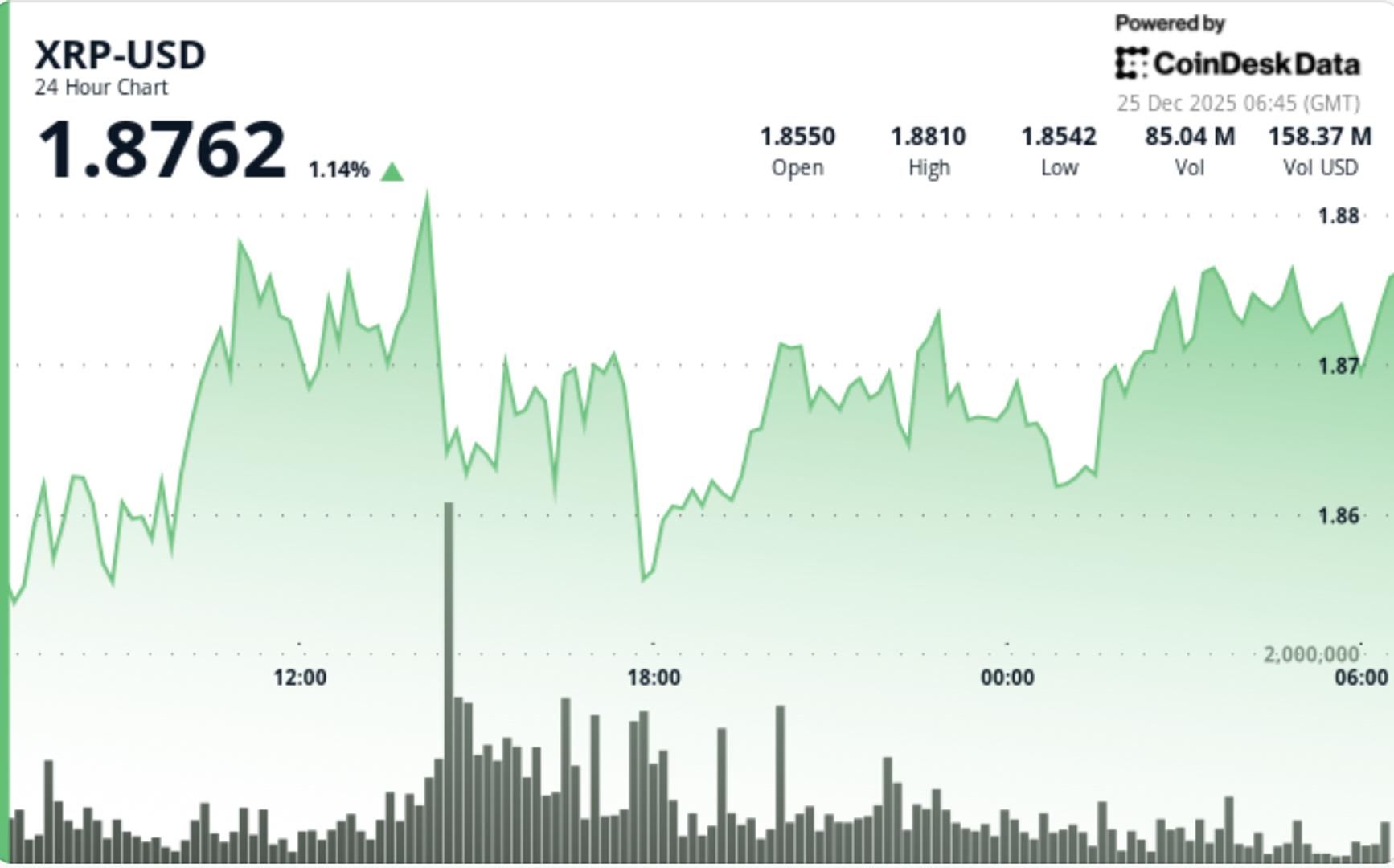

XRP ETF net assets cross $1.25 billion milestone, but price-action muted

Copy linkX (Twitter)LinkedInFacebookEmail