Nasdaq and CME Launch New Nasdaq-CME Crypto Index—A Game-Changer in Digital Assets

Introduction

The Nasdaq Stock Exchange and the Chicago Mercantile Exchange (CME) Group have announced a strategic partnership to unify their cryptocurrency indexing efforts, resulting in the rebranding of the Nasdaq Crypto Index (NCI) as the Nasdaq-CME Crypto Index. This collaboration aims to provide investors with a comprehensive benchmark that reflects broad-market digital asset performance, signaling a maturation in institutional crypto engagement.

Key Takeaways

- Nasdaq and CME Group have combined their crypto indices into a single, collaborative benchmark.

- The index includes major cryptocurrencies such as Bitcoin, Ether, XRP, Solana, Chainlink, Cardano, and Avalanche.

- Market observers see this move as part of a broader shift towards index-based investment strategies within crypto markets.

- The development aligns with increasing institutional interest and the integration of digital assets into traditional finance infrastructure.

Tickers Mentioned:

Tickers mentioned: Bitcoin, Ether, XRP, Solana, Chainlink, Cardano, Avalanche

Sentiment

Sentiment: Positive

Price Impact

Price impact: Positive, as the index partnership enhances credibility and broadens institutional access to diversified crypto investments.

Market Context

Market context: This development reflects ongoing institutional adoption and increasing demand for structured crypto investment products.

Rewritten Article Body

The Nasdaq Stock Exchange and the Chicago Mercantile Exchange (CME) Group have joined forces to merge their respective crypto indexes, culminating in the launch of the Nasdaq-CME Crypto Index. The unified benchmark now encompasses leading cryptocurrencies such as Bitcoin, Ether, XRP, Solana, Chainlink, Cardano, and Avalanche, offering a comprehensive snapshot of the digital asset landscape, according to Nasdaq officials.

Sean Wasserman, Head of Index Product Management at Nasdaq, highlighted the strategic importance of this collaboration. He stated, “We see the index-based approach as the way forward for investors, extending beyond Bitcoin alone. It mirrors how traditional asset classes are represented through broad market indexes.” This move underscores the growing institutional appetite for diversified crypto exposure through structured investment vehicles.

The price of the Nasdaq-CME Crypto Index at the time of writing. Source: Yahoo FinanceThis announcement coincides with a surge in institutional interest in digital assets and blockchain technology. As traditional financial institutions progressively incorporate digital rails, the adoption of crypto indexes is expected to accelerate, facilitating easier access and diversification for passive investors.

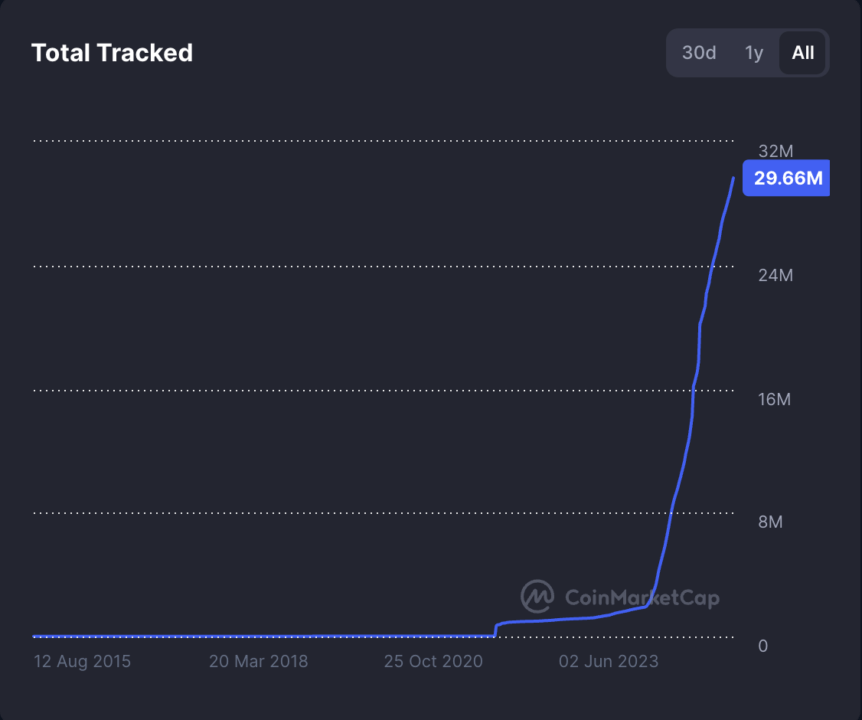

Will Peck, Head of Digital Assets at WisdomTree, emphasized that crypto exchange-traded funds (ETFs) tracking a basket of digital assets could catalyze the next wave of mainstream adoption. He noted, “Crypto indexes simplify the process for investors by aggregating tokens across sectors, reducing the complexity of analysis.” Currently, over 29 million cryptocurrencies are listed on CoinMarketCap, reflecting exponential growth and diversification within the space.

The explosion of listed cryptocurrencies on CoinMarketCap in 2024 and beyond continues. Source: CoinMarketCap

The explosion of listed cryptocurrencies on CoinMarketCap in 2024 and beyond continues. Source: CoinMarketCap

Matt Hougan, Chief Investment Officer at Bitwise, has expressed particular optimism about the growth of crypto index products, seeing them as vital tools for small, passive allocations that do not require extensive sector analysis. He commented, “As the market becomes increasingly complex with multiplying use cases, index-based products will play a crucial role in broadening access and managing risk.”

This shift toward structured, index-based cryptocurrency investment reflects the maturation of the asset class, driven by broader adoption, technological advances, and institutional validation.

This article was originally published as Nasdaq and CME Launch New Nasdaq-CME Crypto Index—A Game-Changer in Digital Assets on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Tim Beiko to focus on ‘frontier use cases’ as Ethereum Foundation shuffles leadership

Tennessee targets Kalshi, Polymarket, and Crypto.com over sports betting