MYX Finance Skyrockets 90%, Here’s What Caused The Rally

MYX Finance price posted an explosive rally over the past 24 hours, surging by nearly 87% at its peak. The sharp move follows rising anticipation around MYX Finance V2.

The upcoming upgrade is expected to allow users to launch perpetual markets instantly, fueling speculation that accelerated sharply today.

MYX Holders Are Backing The Rise

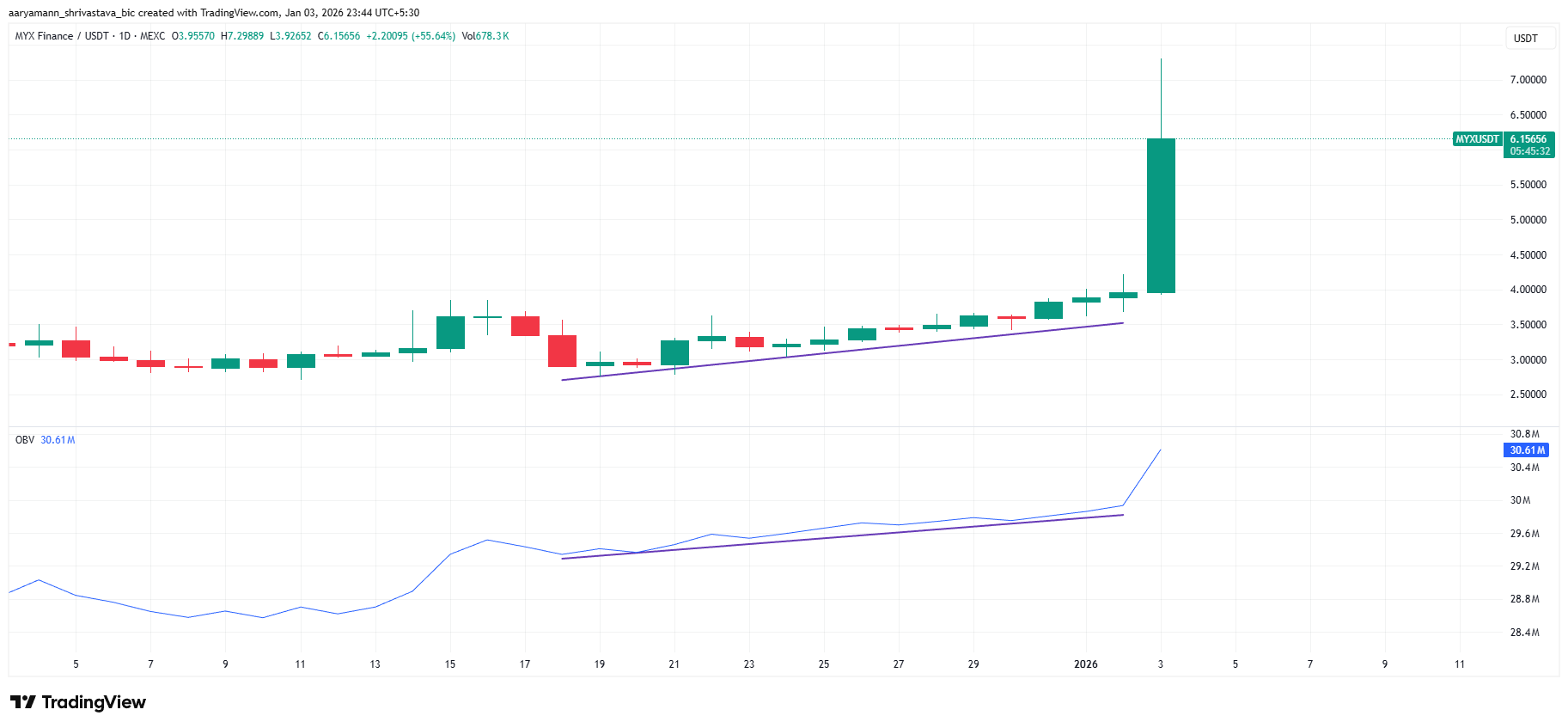

On-chain and volume indicators suggest the rally is supported by genuine demand rather than short-term speculation. The On-Balance Volume indicator recorded a sharp spike alongside the price. OBV had been rising steadily over several sessions, indicating sustained accumulation before the breakout.

This gradual buildup reflects increasing conviction among buyers. When price finally accelerated, volume followed decisively, confirming participation across the market.

Such alignment between MYX price and OBV often signals healthier rallies, as capital inflows support continuation rather than abrupt reversals driven by thin liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

MYX OBV. Source: TradingView

MYX OBV. Source: TradingView

Sustained volume expansion reduces the likelihood of immediate exhaustion. Buyers appear willing to transact at higher levels, reinforcing confidence in MYX Finance’s growth narrative. This behavior suggests the rally is not solely sentiment-driven but grounded in broader market engagement.

MYX Is Used To The Danger Zone

Momentum indicators introduce caution but also context. The Relative Strength Index has climbed above the 70.0 threshold, placing MYX in overbought territory. Traditionally, this condition raises concerns about near-term pullbacks as traders lock in profits.

However, MYX Finance has previously sustained strong rallies while remaining overbought. In August 2025, MYX gained roughly 1,680% without immediate correction. A similar pattern emerged in September 2025, when the price advanced by over 913% during extended overbought conditions.

MYX RSI. Source: TradingView

MYX RSI. Source: TradingView

These historical precedents suggest RSI alone may not signal exhaustion for MYX. In strong narrative-driven phases, momentum can remain elevated for prolonged periods. The current RSI reading reflects strength rather than guaranteed reversal.

MYX Price Finally Escapes

MYX price climbed more than 87% at its peak during the last 24 hours, trading near $6.12 at the time of writing. The rally briefly carried MYX above the $7.00 level, a threshold last seen roughly three months ago, signaling renewed market interest. This also helped MYX break out of the ascending channel pattern it had been stuck in for over two months.

Technical and momentum indicators favor continuation if support is established. Securing $7.00 as a stable support zone remains the next critical objective. If achieved, MYX could extend gains toward $8.90, with $10.00 emerging as a psychological recovery target.

MYX Price Analysis. Source: TradingView

MYX Price Analysis. Source: TradingView

Downside risk persists if profit-taking accelerates. Many holders have waited several months for favorable exit conditions. A wave of selling could pressure the price below $5.83. Losing this level would weaken the structure and potentially send MYX toward $4.54, invalidating the bullish thesis.

You May Also Like

CME Group to launch options on XRP and SOL futures

What is Play-to-Earn Gaming? Unlocking New Possibilities