LIT Token Plunges 22% as Lighter Airdrop Distribution Goes Live

LIT, the newly launched token of decentralized perpetuals exchange Lighter, slid sharply in pre-market trading on Tuesday as its long-awaited airdrop distribution went live, triggering heavy selling from early recipients and leveraged traders.

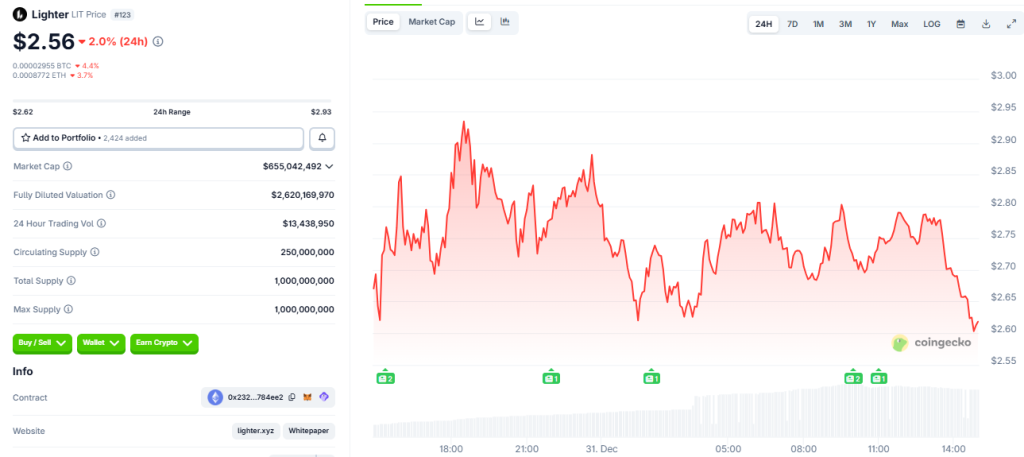

The token initially climbed to a post-launch high of $4.04 shortly after trading began before reversing course and falling to around $2.62, a drop of roughly 22.2%.

Source: CoinGecko

Source: CoinGecko

That price also marked LIT’s lowest level since launch, reflecting sustained downside pressure as the market absorbed the large token distribution.

LIT Sees Heavy Trading as Selling Outpaces Early Accumulation

However, despite this excessive drop in price, the trading volume increased over the past 24 hours, as LIT experienced 13.43 million in trading volume, which is almost three times the amount that was experienced the day before.

The increased volume was an indication of higher involvement in the market, which was mostly because of volatility, short-term speculation, and unwinding of positions, and not as a result of long-term accumulation.

LIT is trading nearly 35% less than it was at its peak, and the token is now squarely in a post-launch correctional period, with the price discovery still underway.

Data on-chain that was based on the airdrop provided additional information concerning the selling pressure, and the analysis of 10,000 wallets performed just after the distribution revealed that approximately 198.86 million LIT tokens were received by the participants initially.

The existing balances in all those wallets are approximately 183.29 million LIT, which means that a significant part of the airdropped supply has already been decreased.

Only 7.77% of wallets increased their holdings, while 45.88% reduced their balances and 46.35% made no changes, indicating that selling activity outweighed accumulation.

In absolute terms, about 150.34 million LIT, or roughly 75.6% of the airdropped tokens, remain held. Around 48.52 million tokens, or 24.4%, have been sold or transferred.

At the same time, only about 32.95 million LIT, representing 16.57% of the total, can be categorized as accumulated beyond initial allocations.

The imbalance suggests that buy-side conviction has lagged behind sell-side activity in the early trading window.

Lighter’s LIT Joins one of Crypto’s Largest Airdrops even as Tokenomics Come Under Scrutiny

Derivatives market data reinforced this picture, as net flow indicators for LIT perpetual contracts showed consistent aggressive selling across multiple time frames.

Net delta was negative by about $108,000 over one hour, widened to nearly $1 million over four hours, and deteriorated to more than $6 million over ten hours.

Hourly net flow data over the last day also showed repeated negative swings, suggesting that price rebounds were met with renewed selling.

The sell-off followed one of the largest token giveaways in crypto history as Lighter airdropped roughly $675 million worth of LIT tokens to early users, ranking the distribution as the 10th largest airdrop by dollar value, according to CoinGecko data.

The airdrop surpassed 1inch Network’s 2020 distribution but remained well below Uniswap’s record-setting $6.43 billion airdrop.

Some early users reported receiving six-figure allocations, highlighting the scale of the distribution.

At the same time, debate around Lighter’s tokenomics intensified. Half of the total LIT supply is allocated to users, partners, and growth initiatives, while the remaining 50% is reserved for the team and investors, subject to a one-year cliff and multi-year vesting.

The launch comes as Lighter continues to post strong trading metrics within a rapidly expanding on-chain derivatives market.

The platform processed roughly $3.90 billion in 24-hour perpetual volume and about $201 billion over 30 days, placing it among the top decentralized venues alongside Hyperliquid and Aster.

The broader perpetuals DEX sector has seen explosive growth in 2025, with cumulative volume reaching $12.09 trillion and more than $7.9 trillion generated this year alone.

You May Also Like

Prenetics Halts Bitcoin Treasury Buys, Keeps 510 BTC

Rep. Warren Davidson criticizes US crypto policy, calls it a threat to Bitcoin’s core principles