Pi Coin Price Prediction: What to Expect In 2026?

Pi Coin has struggled to gain meaningful traction, reflecting weak conviction among investors. The altcoin endured a difficult 2025, marked by persistent selling pressure and limited recovery attempts.

Despite brief rebounds, sentiment remains fragile. As Pi Coin enters 2026, expectations of a sustained recovery remain uncertain amid inconsistent demand signals.

Pi Coin Has Not Performed Exceptionally

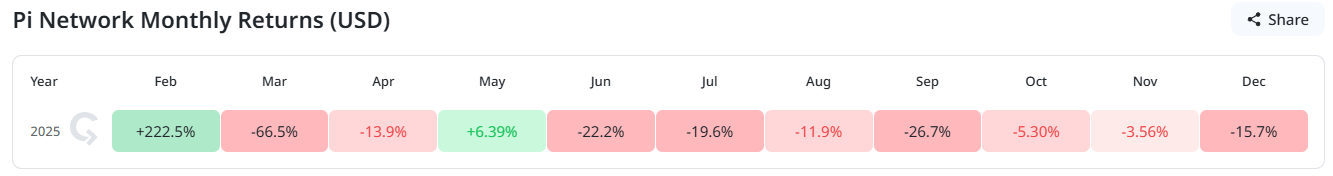

Monthly return data paints a challenging picture for Pi Coin’s first year. Since launching in February, the token has recorded losses in most months. Only two periods delivered positive returns, highlighting the asset’s inability to sustain momentum.

The steepest decline occurred shortly after launch. In March, Pi Coin fell 66.5%, erasing early optimism around the mobile mining network. This sharp drawdown set a negative tone that has persisted. Historically weak monthly performance suggests downside risks continue to outweigh upside expectations.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin Price Performance. Source: Cryptorank

Pi Coin Price Performance. Source: Cryptorank

However, February 2026 could offer a short-term catalyst. The altcoin will mark its first anniversary, a milestone that often draws renewed attention. Speculative interest around anniversaries has previously driven temporary rallies across emerging crypto assets.

Investors Lost Their Confidence Early On

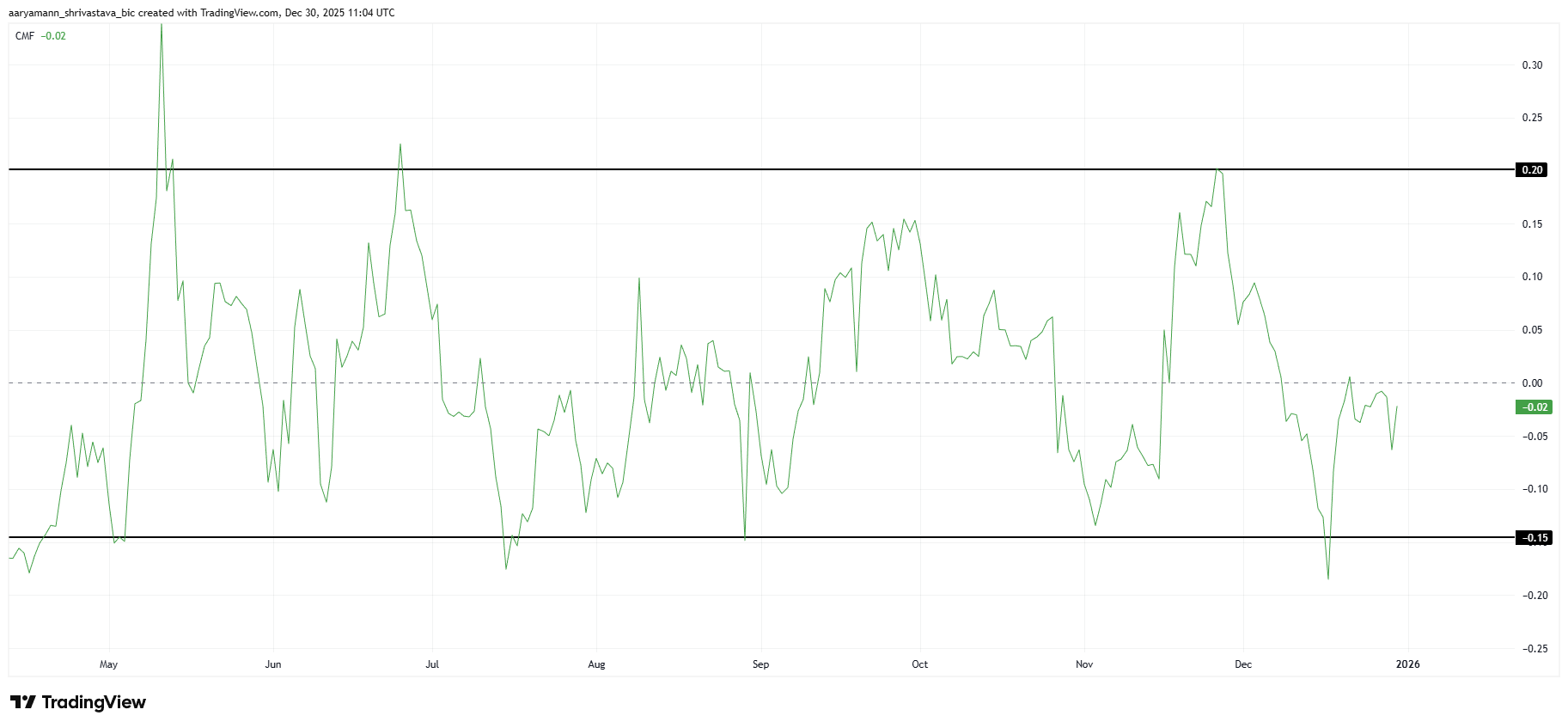

Capital flow indicators further explain Pi Coin’s prolonged weakness. Over the past year, the asset has oscillated between inflows and outflows without establishing a clear trend. This indecision among investors has constrained price recovery attempts.

The Chaikin Money Flow highlights persistent selling dominance. Since launch, CMF has reached the oversold threshold of -0.15 on five occasions. By contrast, it has only touched the overbought level of 0.20 three times, signaling stronger selling pressure.

Pi Coin CMF. Source: TradingView

Pi Coin CMF. Source: TradingView

Even if CMF rises above the zero line, recovery remains uncertain. Historically, meaningful trend reversals for Pi Coin have required CMF to exceed 0.20. Without that confirmation, rallies risk fading quickly amid renewed distribution.

What Does Pi Coin Need To Recover?

From a broader perspective, Pi Coin faces a steep climb to regain credibility. The altcoin must rise roughly 1,376% to revisit its all-time high of $2.994, set in early March. Such a move would require a significant shift in demand.

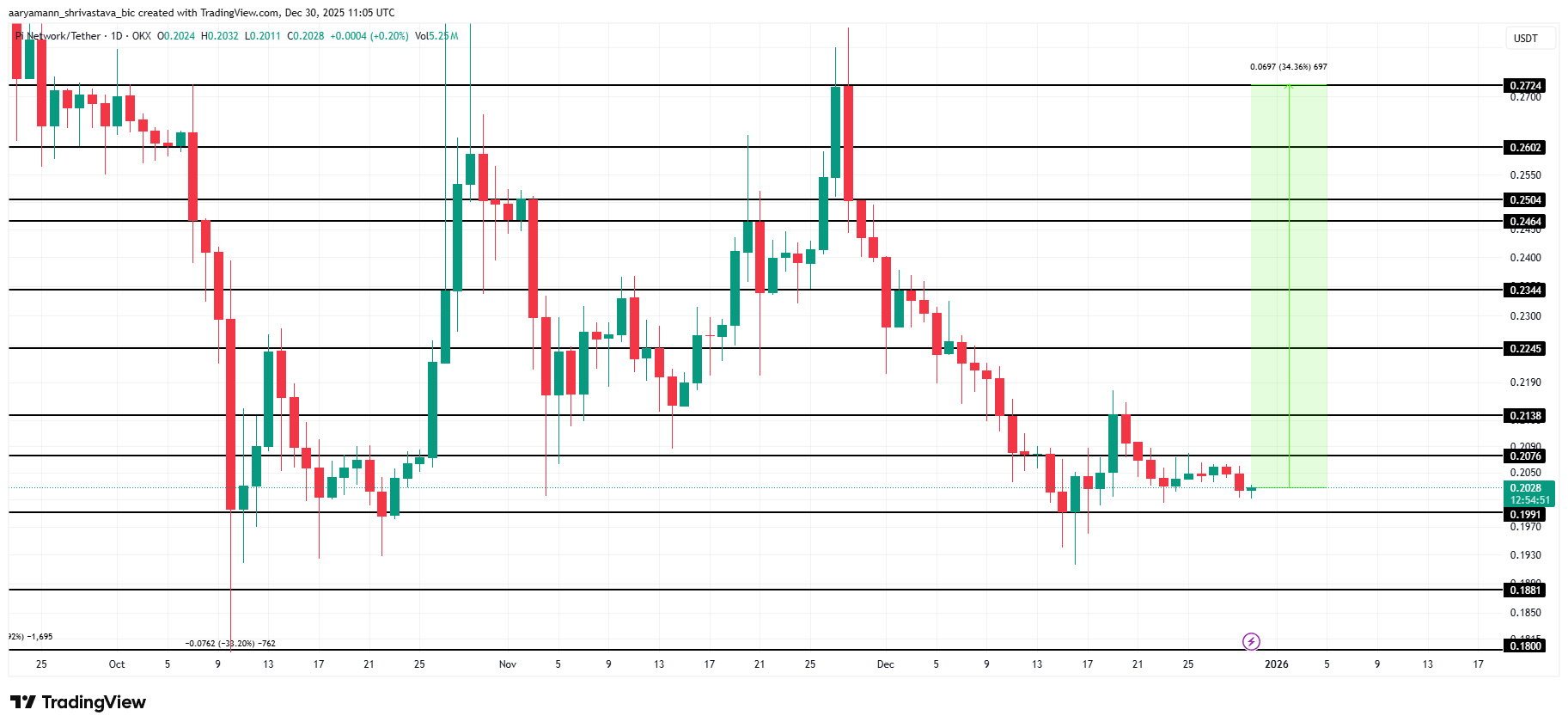

Initial recovery signals would emerge if Pi Coin flips the 23.6% Fibonacci Retracement level at $0.273 into support. This level represents the first technical threshold separating consolidation from early recovery.

Pi Coin Price Analysis. Source: TradingView

Pi Coin Price Analysis. Source: TradingView

Stronger confirmation remains distant. A sustained bullish structure would require reclaiming $0.662 as support. Until then, Pi Coin remains in a prolonged rebuilding phase with limited upside conviction.

PI Price May Not See Much Growth

In the short term, Pi Coin shows tentative strength. The token holds above the critical $0.199 support level. This floor has been tested three times without a daily close below, suggesting buyers are defending this zone.

Maintaining this support keeps the short-term momentum constructive. As long as $0.199 holds, downside risks remain contained. This behavior supports a cautiously bullish outlook over the coming weeks.

To offset December’s losses, Pi Coin requires a 34% rally. Such a move would lift the price toward $0.272. In the near term, reclaiming $0.224 and $0.246 as support levels remains the primary objective.

Pi Coin Price Analysis. Source: TradingView

Pi Coin Price Analysis. Source: TradingView

Achieving these targets would indicate improving sentiment. Gradually higher lows could attract speculative interest, especially if broader market conditions stabilize. Still, volume confirmation remains essential for sustainability.

Downside risks persist if investor confidence deteriorates. A breakdown below $0.199 would invalidate the bullish thesis. Under that scenario, Pi Coin could slide toward $0.188 or lower, accelerating losses amid panic-driven selling.

You May Also Like

Trump Media received 260 BTC from Coinbase, worth $21 million.

Sei Enhances Market Infrastructure with Real-Time Data and Transparency